Introduction

In latest https://www.express-finance.co.uk/ccj-loans-direct-lender-uk/ financial panorama, the adventure of homeownership should be would becould very well be riddled with challenges. Particularly for house owners with dangerous credit score or these struggling lower than the burden of debt, handling funds can consider like an uphill fight. However, there exists a silver lining inside the style of awful credit score secured loans for debt consolidation. These economic gear can empower home owners to reclaim control over their fiscal destiny, even when facing hurdles including poor credits scores.

In this accomplished article, we are going to delve deep into the sector of unhealthy credits secured loans and explore how they will serve as a transformative answer for lots individuals and households. From knowing what these loans entail to reading their merits and conceivable drawbacks, we purpose to furnish you with an informative handbook that may exchange your lifestyles.

Understanding Bad Credit Secured Loans

What Are Bad Credit Secured Loans?

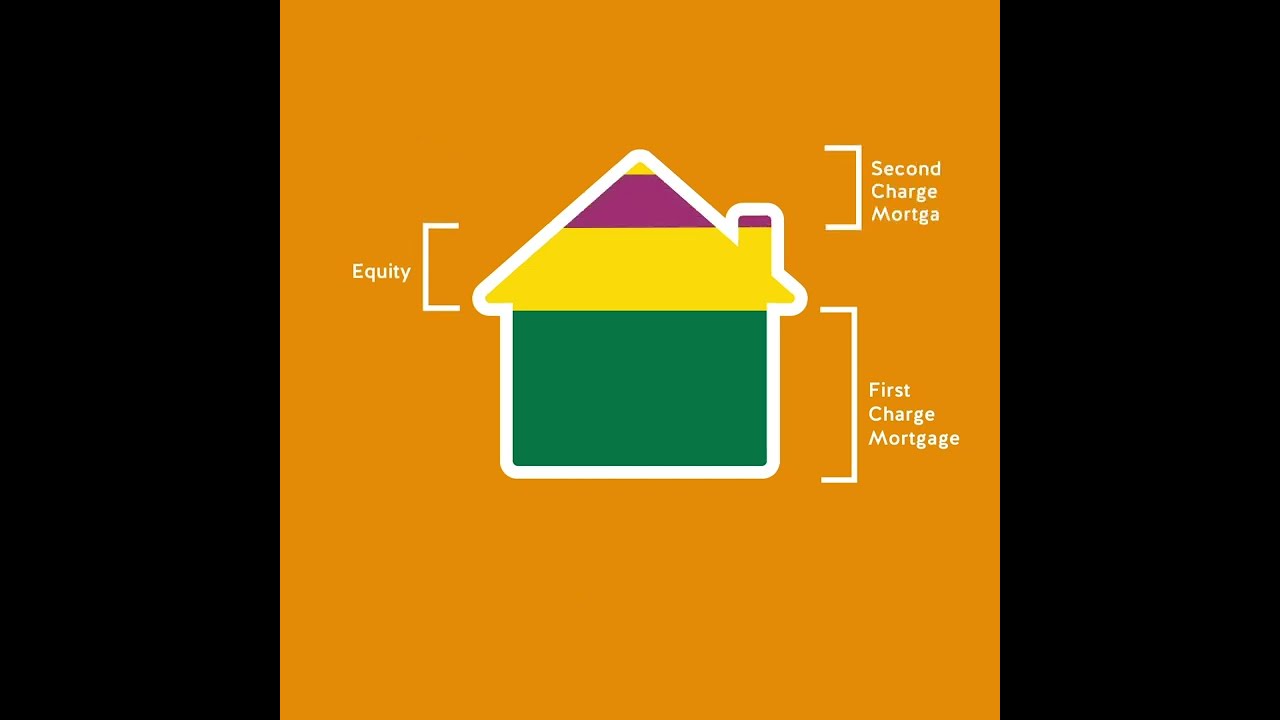

Bad credits secured loans are economic products designed in particular for participants with terrible credits rankings. Unlike unsecured loans, which rely totally on a borrower's creditworthiness, secured loans require collateral—primarily a powerful asset like a domestic or motor vehicle—to back the loan quantity.

Express Finance Credit OptionsWhy Opt for Secured Loans Over Unsecured Loans?

Lower Interest Rates: Since secured loans are backed by way of collateral, lenders mainly provide lower passion charges as compared to unsecured loans. Higher Loan Amounts: Borrowers also can get entry to bigger sums caused by the diminished threat to creditors. Better Approval Rates: Individuals with poor credits quite often find it more straightforward to qualify for secured loans than unsecured options.Who Should Consider Bad Credit Secured Loans?

Homeowners who're grappling with substantive debt or excessive-passion tasks should always trust poor credits secured loans. This consists of:

- Homeowners suffering with numerous debts Individuals searching for an comparatively cheap manner to handle current mortgages Those looking to amplify their credits rankings over time

The Role of Debt Consolidation

What Is Debt Consolidation?

Debt consolidation entails combining more than one bills into one unmarried cost, ideally at a slash pastime price. This procedure simplifies repayments and will tremendously scale back per month charges.

How Can Bad Credit Secured Loans Aid in Debt Consolidation?

By utilizing terrible credit score secured loans for debt consolidation, owners can pay off top-hobby debts and streamline their price range. This no longer basically makes bills extra achievable yet also supports in recovering general economic wellbeing.

Pros and Cons of Using Bad Credit Secured Loans

Advantages of Bad Credit Secured Loans

Improved Cash Flow: Lower per 30 days payments unfastened up coins for different obligatory charges. Potential Credit Score Improvement: Timely funds on new loans can step by step make stronger your credit score ranking. Instant Decision Online: Many direct creditors present swift approvals using on line programs.Disadvantages of Bad Credit Secured Loans

ExpressFinance Deals Risk of Losing Collateral: Defaulting on those loans may additionally set off shedding the asset used as collateral. Fees and Charges: Some lenders impose hefty costs which might add in your ordinary debt burden. Limited Accessibility: Not all creditors cater notably to people with negative credits rankings.Empowering Homeowners Through Financial Literacy

The Importance of Financial Education

Financial literacy is fundamental for amazing control of personal budget, peculiarly while managing poor credits events. Homeowners need to bear in mind a variety of economic products possible to them and how they paintings.

Tools for Financial Education

- Online Courses: Various platforms supply programs on budgeting and debt control. Financial Advisors: Consulting specialists can grant custom-made guidance tailor-made to man or women occasions. Books & Resources: A plethora of literature exists that makes a speciality of improving financial control abilities.

How To Qualify For A Bad Credit Secured Loan

Understanding Eligibility Criteria

Qualifying for a unhealthy credits secured personal loan ordinarilly comprises assembly guaranteed standards:

Collateral Requirement: You must own an asset (e.g., your home) that would be used as collateral. Proof of Income: Lenders will check your cash point to ascertain compensation means. Credit History Review: While negative credits might not disqualify you, some lenders will still review your past borrowing habit.Steps To Apply For A Loan

Research Direct Lenders: Look for official institutions that specialize in bad credit lending. Gather Required Documentation: Be willing to give identity, revenue statements, and property documents. Submit Your Application Online: Many lenders provide immediate selection on-line procedures that expedite approval instances.Tips For Managing Your New Loan

Create a Realistic Budget

Once you've got you have got secured a loan, that's principal to create a finances that accommodates your new monthly payment schedule when making sure you may have sufficient money left over for dwelling costs.

Monitor Payments Regularly

Stay vigilant approximately making well timed bills; overlooked repayments can exacerbate your already fragile fiscal difficulty.

FAQs About Bad Credit Secured Loans

1. What is regarded as "unhealthy" or "poor" credit?

Credit scores underneath 580 are traditionally categorised as bad or unhealthy via so much scoring types.

2. How does collateral paintings in secured loans?

Collateral acts as safeguard opposed to the loan amount; if you happen to default, the lender has the suitable to trap this asset.

3. Can I get a no credit score payment mortgage?

Some lenders also can supply no-credits-look at various possibilities; but it surely, these most of the time come with higher curiosity rates and stricter phrases.

four. How straight away can I acquire payments?

Many direct lenders deliver prompt choices on line; upon approval, funds may very well be out there inside days.

five. Will my personal loan influence my eligibility?

Existing mortgages may possibly have an impact on how a great deal you qualify for however having one does now not automatically disqualify you from securing any other personal loan.

6. Can I enhance my score although repaying my personal loan?

Yes! Consistently making on-time payments can assist give a boost to your total credit ranking over time.

Conclusion

Navigating the complexities of price range as a homeowner with poor or negative credit doesn't ought to consider insurmountable. By information how bad credit score secured loans work and leveraging them correctly by way of debt consolidation strategies, owners can empower themselves in direction of ExpressFinance SW London attaining improved economic balance and freedom.

With careful planning, schooling, and give a boost to from direct lenders featuring immediate choices on-line options tailor-made specifically for those dealing with an identical demanding situations—transforming your fiscal long term is inside achieve!

This article serves as an in bad credt secured loans depth publication aimed toward educating readers approximately leveraging horrific credit secured loans thoroughly whereas offering them with actionable insights mandatory for suggested selection-making involving their monetary futures!