Introduction

In present day financial panorama, many home owners grapple with the drawback of getting access to money by using a poor credit score ranking. Fortunately, secured loans for terrible credit offer a doable solution. These loans enable home owners to leverage their property fairness, permitting them to comfortable financing even if common lenders may perhaps flip them away. This article delves into the nuances of unlocking abode fairness thru secured loans, particularly specializing in innovations conceivable for people with undesirable credits ratings.

Unlocking Home Equity: Secured Loans for Bad Credit with Instant Decisions from Direct Lenders in the UK

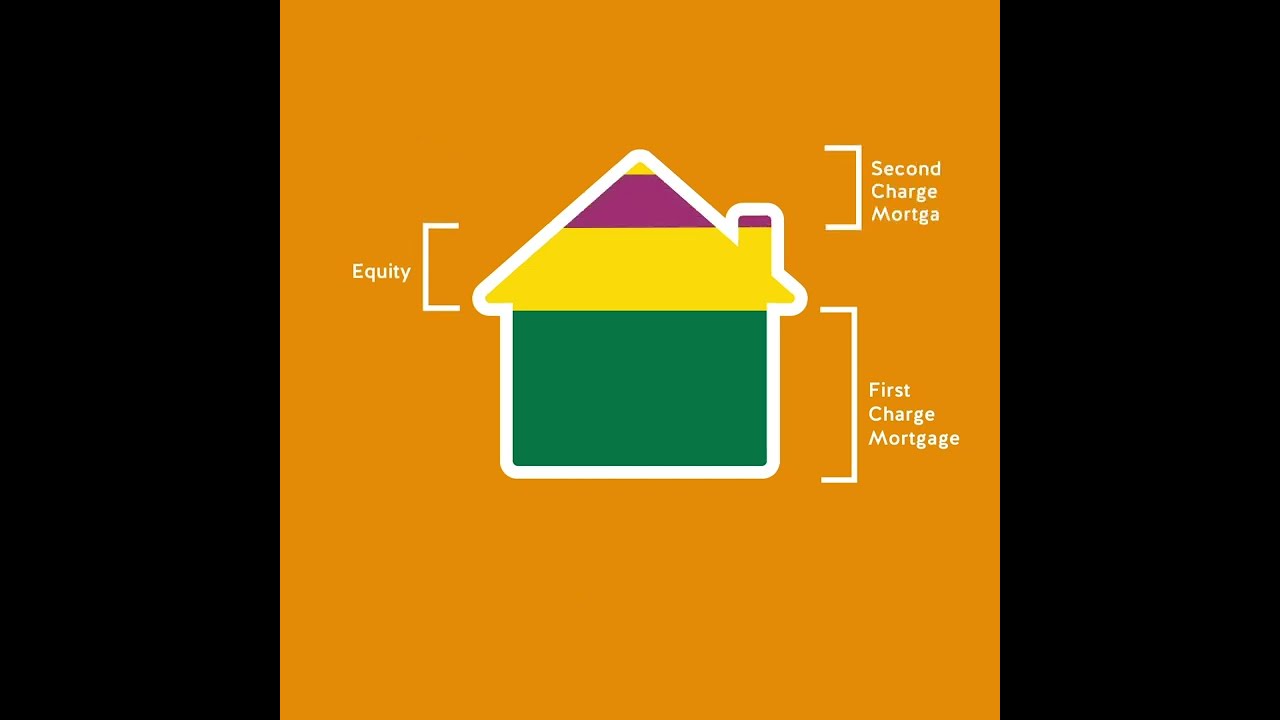

Home equity refers back to the component to your private home bad credt secured loans that you really possess. By tapping into this equity, householders can get entry to awesome cash due to secured loans. Unlike unsecured loans, which depend exclusively on creditworthiness, secured loans require collateral—in this situation, your bad credt secured loans private home. This introduced security makes it less difficult for lenders to approve loans even if in case you have a poor credits rating.

What are Secured Loans?

Secured loans are borrowing options wherein the borrower delivers an asset (equivalent to a dwelling) as collateral. This reduces risk for creditors and allows debtors with terrible credits histories more advantageous access to funds.

How Do Secured Loans Work?

Secured loans paintings via making use of the price of your private home as collateral. When you apply for a personal loan:

- The lender assesses your property's worth. Based on this valuation and your monetary obstacle, they ensure how tons you could possibly borrow.

If you fail to repay the personal loan, the lender has the top to trap your house to get well their losses.

Benefits of Secured Loans for Bad Credit

Secured loans supply more than a few reward that lead them to eye-catching:

Higher Borrowing Limits: Because those loans are backed through collateral, lenders ordinarily permit large sums. Lower Interest Rates: Compared to unsecured lending choices, secured loans typically include slash curiosity quotes. Flexible Repayment Terms: Many lenders present bendy phrases which will accommodate quite a lot of economic instances. Instant Decisions: With direct lenders, you would more often than not obtain an instantaneous determination on your program.Challenges of Secured Loans

While there are numerous benefits to secured loans, it really is elementary to be conversant in expertise challenges:

Risk of Losing Your Home: If you are not able to meet repayments, you have to face foreclosure. Fees and Charges: Some lenders may impose hidden expenditures that could develop average borrowing expenses. Credit Checks: While awful credit score would possibly not disqualify you outright, a few degree of credit score contrast is still everyday train.Types of Secured Loans Available inside the UK

Understanding varied sorts of secured loans can guide householders make proficient decisions:

1. Second Charge Mortgages

A 2d fee personal loan permits property owners to borrow payment in opposition to their assets whilst sustaining an existing mortgage. It's most appropriate for those looking for extra funding with out refinancing their principal mortgage.

2. Homeowner Loans

Homeowner loans are in particular designed for folks who possess estate however have a poor credits score. These loans think ExpressFinance New Lenders of domestic fairness as opposed to simply credits rankings.

3. Remortgaging Options

For a few householders suffering with top-attention prices or destructive phrases on their recent mortgages, remortgaging is perhaps an preference price thinking.

How to Apply for Secured Loans

The utility approach has been streamlined radically via direct lenders within the UK:

Step 1: Assess Your Financial Situation

Before utilising for any loan:

- Evaluate your income and prices. Determine how so much equity you've in your property.

Step 2: Research Lenders

Look notably for direct creditors who offer secured mortgage selections tailor-made for those with dangerous credit score rankings.

Step 3: Complete Your Application

Most lenders facilitate on line programs in which you input very own important points and economic info.

Step four: Receive Your Offer

Once submitted, one could acquire a suggestion detailing:

- Borrowing limits Interest rates Repayment terms

FAQ Section

1. Can I get a secured mortgage with an exceptionally awful credits rating?

Yes! There are designated creditors focused on imparting secured loans even you probably have a really unhealthy credits score.

2. What is the distinction between secured and unsecured loans?

Secured loans require collateral (like your property), whilst unsecured ones do not rely on any asset backing.

3. How straight away can I get authorized?

With many direct creditors proposing on the spot choices, approval can frequently manifest within mins or hours after submission.

four. Are there consequences for early repayment?

It varies through lender; a few may impose penalties whilst others enable early compensation devoid of further expenditures.

5. What happens if I are not able to pay off my mortgage?

If repayments aren’t made, the lender has the good to repossess your private home used as collateral.

6. Can I use my mortgage for any rationale?

Generally conversing, sure! Most creditors don’t limit usage—popular purposes incorporate debt consolidation or residence improvements.

Conclusion

Unlocking domicile fairness with the aid of secured loans affords a lifeline for owners suffering with deficient credits scores in the UK. By information how those fiscal merchandise work and what solutions exist inside this realm—pretty those supplying wireless approvals from direct creditors—that you would be able to make properly-advised decisions approximately coping with price range quite simply and responsibly amidst challenging conditions.

As we navigate because of uncertain monetary instances and fluctuating markets, securing financing turns into important no longer simply as a device yet as element of strategic making plans—ensuring that participants hold stability even with monetary adversities is crucially fabulous now more than ever before!